Culture & Mergers & Acquisitions Strategy

A sophisticated discipline or a “roll of the dice”?

By Bryan Adkins Ed.D., CEO, Denison Consulting

Perhaps there is no business situation that epitomizes the saying that “culture eats strategy” more than mergers and acquisitions. By now, most everyone knows the statistics – somewhere between 60 and 70% of mergers and acquisitions fall short of expectations. And yet we still roll the dice and hope that ours will be among the precious few that defy the odds. Acquisitions remain at the core of many growth strategies.

The appeal is quite clear – immediate access to new technologies, talent, intellectual property and geographies. So too are the risks – voluntary turnover of key talent, underestimation of the time and resources needed to integrate, power struggles, stressed employees, job losses, strategy shifts and an overall infusion of uncertainty and ambiguity. A classic high-risk, high-reward scenario.

In the culture work that we do, we often talk about high-performing organizations and the notably higher levels of clarity and alignment they have created regarding what they do, why they do it, and how they do it. The enemy of clarity and alignment is uncertainty and confusion. Among the internal changes that have the greatest potential to create uncertainty in organizations are leadership changes, shifts in strategy, restructuring and significant systems (IT, financial, HR) implementations. Almost every M&A deal will result in several, if not all, of these changes occurring, either simultaneously or in fast succession.

Given the high complexity of the challenge and the low odds of success, one might conclude that it is better to just get up and walk away from M&A as a strategy. The trillions of dollars spent on M&A’s across the globe in recent years, however, suggest that no one is heading to the exits.

Even though the risks are well known, many leaders still cross their fingers and hope for the best when combining companies. The deal looks good on paper and they have convinced themselves that it is meant to be. Carl Sagan once said, “The more badly we want to believe it, the more skeptical we need to be. It involves a kind of courageous self-discipline.” Yet skepticism and discipline often seem to be in short supply when leaders start talking about their next deal – especially when it comes to culture integration.

We believe that culture integration work is meant for those who are ready to roll up their sleeves, not cross their fingers. It is possible to more quickly and fully realize the desired synergies a merger or acquisition can offer. But to do so means that culture due diligence and integration cannot be an afterthought. Failure to get it right means that the promises made to the marketplace can come crumbling down into a smoldering heap of unmet expectations.

Culture awareness, understanding and management can be done with the same discipline that is often applied to the legal, financial, technological and operational integration efforts.

Your culture integration strategy should include

the following key components:

the following key components:

Be clear about your culture: The key here is “know thyself.” A client recently reached out to us and said that they are looking at a series of acquisitions as part of their growth strategy, but before they get underway they’d like to better understand their own culture. This is critical when preparing for the integration of other organizations. What is the culture an acquisition is coming into? A medical product manufacturer working with Denison is doing just that – starting with understanding their culture in an effort to effectively manage their culture as they plan for the integration of acquisitions into their company.

The acquisition should support the vision and strategy: The Board and Senior Executives must be able to articulate the value proposition expected from a merger or acquisition. We push our clients hard to understand the types of acquisitions they are thinking about and the level of integration expected. This allows leaders to better articulate how a deal supports their growth strategy and the level of culture integration work that will be needed.

Initiate Target Identification and Culture Due Diligence: Clients often ask, “Can you help us in the target identification and due diligence phases, where a full-blown culture assessment is not feasible?” The answer is, “Yes!” There is a wide range of data about organizations that is available in the public domain today. Social media and company websites can be analyzed to help in the identification of possible targets and throughout the due diligence phase.

When a global furniture manufacturer identified a potential acquisition that supported their strategic growth plan, we provided the Board and leaders with an in-depth analysis of the culture so they could make an informed decision to proceed, anticipate the synergies, and effectively address the risks for culture clashes.

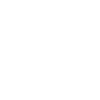

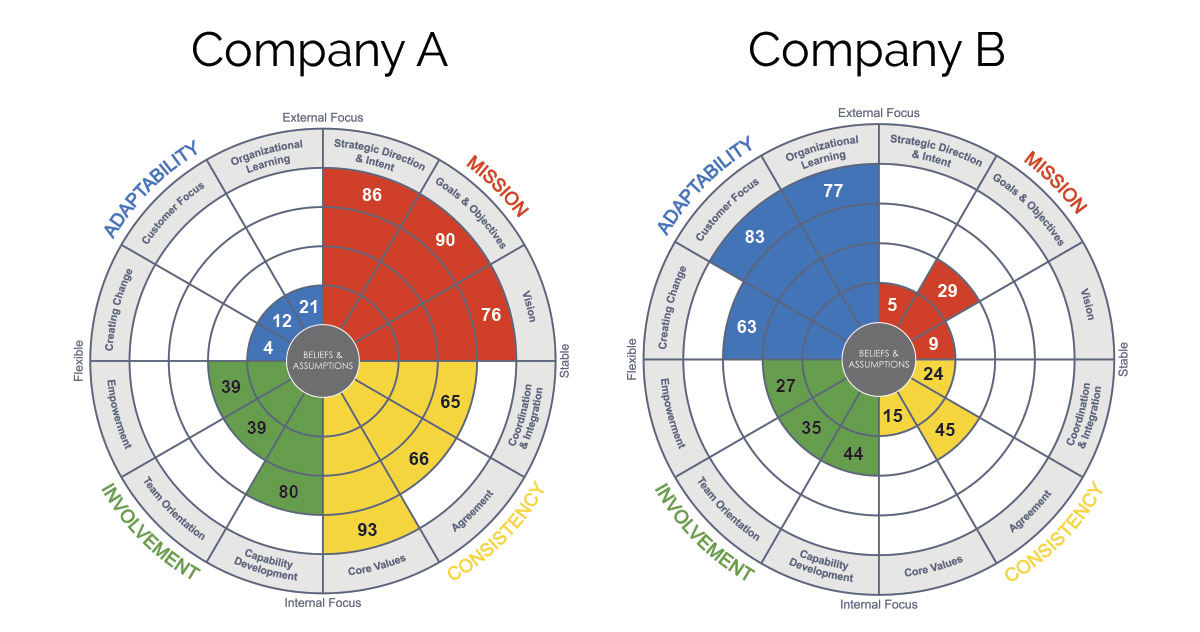

Manage Transition Planning and Team Alignment: Knowledge is power. Imagine standing at the edge of a minefield – needing to get to the other side. Now imagine someone handing you a map that shows where the mines are located. Knowing the cultural landscape of the respective organizations allows the transition and integration teams to proceed with the confidence that they are focusing on issues relevant to business performance and an understanding of where the cultural landmines are located. The Denison culture assessment provides such a map.

The culture profiles generated provide a clear picture of where potential gaps exist and where best practices are evident. This data collection allows for input from employees in the respective organizations and involves them in the culture integration process. Everyone can quickly and easily become aware of the potential areas of clash and turn that awareness into specific plans for closing the gaps.

Define and Execute Day 1 Integration: The deal has been signed and the real work of bringing the organizations together begins. The Denison Model and cultural insights developed will provide a roadmap for the culture integration process. What is the common Vision for the future? What Values will guide behavior? How do we balance internal integration with the external needs of the marketplace? The roadmap keeps you focused on the activities that create unity, foster alignment and impact business performance. A certain consumer products company not only used the culture assessment, they used the Denison Model to create a one-year M&A integration plan that prioritized their Mission, Vision and Values while identifying other integration activities that would help build effective teams, foster coordination across the newly forming entity, and focus the workforce on the creation of a single, high-performing organization.

Commit to ongoing culture development: Integration of one or more organizations is important work. However, culture is a living, dynamic asset (or liability) that needs constant attention and management. There may be more acquisitions to make. The competitive landscape will change. Leaders and technologies will come and go. Being intentional about culture and culture management is a sophisticated competence that offers a sustainable competitive advantage. Organizations that first reach out to engage in culture work due to an acquisition learn quickly that the insights provided offer critical insights about the company that bring them back on a regular basis. Culture understanding and management becomes a core business competence.

When it comes to culture in the integration process, some still choose to “roll the dice.” Seasoned acquirers develop a discipline that reduces the risk of culture clashes undermining their acquisition strategy. What is your approach?

If you would like support in this process, please be in contact with us. We can help you achieve transformation right to the bottom line.