Want to Know the Future Success of a Company? Measure the Culture.

Culture is a leading indicator of where a business is headed. While most financial metrics show past performance, focusing on culture reveals future potential.

Private Equity (PE) is known for operating model rigor that runs on a defined set of metrics designed to create results in a specified time period. Companies seeking investment gravitate toward Private Equity for many reasons, including the advanced operating capabilities, experienced experts available, and these firms’ proven business growth methodologies.

Like many people, you might not consider measuring culture as a leading indicator of operational success. It may surprise you that many PE firms do. They see culture in a broader context that includes leadership and organizational effectiveness. This broader view of culture is an asset that returns value in their portfolio companies. As a result, culture, leadership, and organizational effectiveness are now areas of operating expertise that PE firms can provide to their portfolio companies.

The most advanced PE companies measure, manage, and leverage culture, leadership, and organizational effectiveness combined to optimize time to value and the overall valuation of their portfolio companies.

As someone who has spent my career in data-intensive, fast-moving companies, I can appreciate the need to measure things to manage them better. It’s encouraging to see more and more PE firms embracing culture as an operating performance engine. Recently Alix Partners’ Annual Private Equity Survey noted that historically, culture assessment was not part of the due diligence nor company valuation in most investment decisions. This trend is now changing because culture is measurable.

At Denison Consulting, we also envision culture more broadly to include leadership that sets the strategy and tone of an organization, culture as the way employees work and things get done, and organizational effectiveness as the outcomes of leadership and culture together. All of this can be measured through our Denison Model Assessment and various Impact Solutions. Working with our clients, we’ve seen that when you measure culture, it becomes a board-level conversation because it can be measured and trended over time with focused, outcome-oriented operating performance plans. Leading PE firms know this and use it to optimize time to value and overall value creation in their investments.

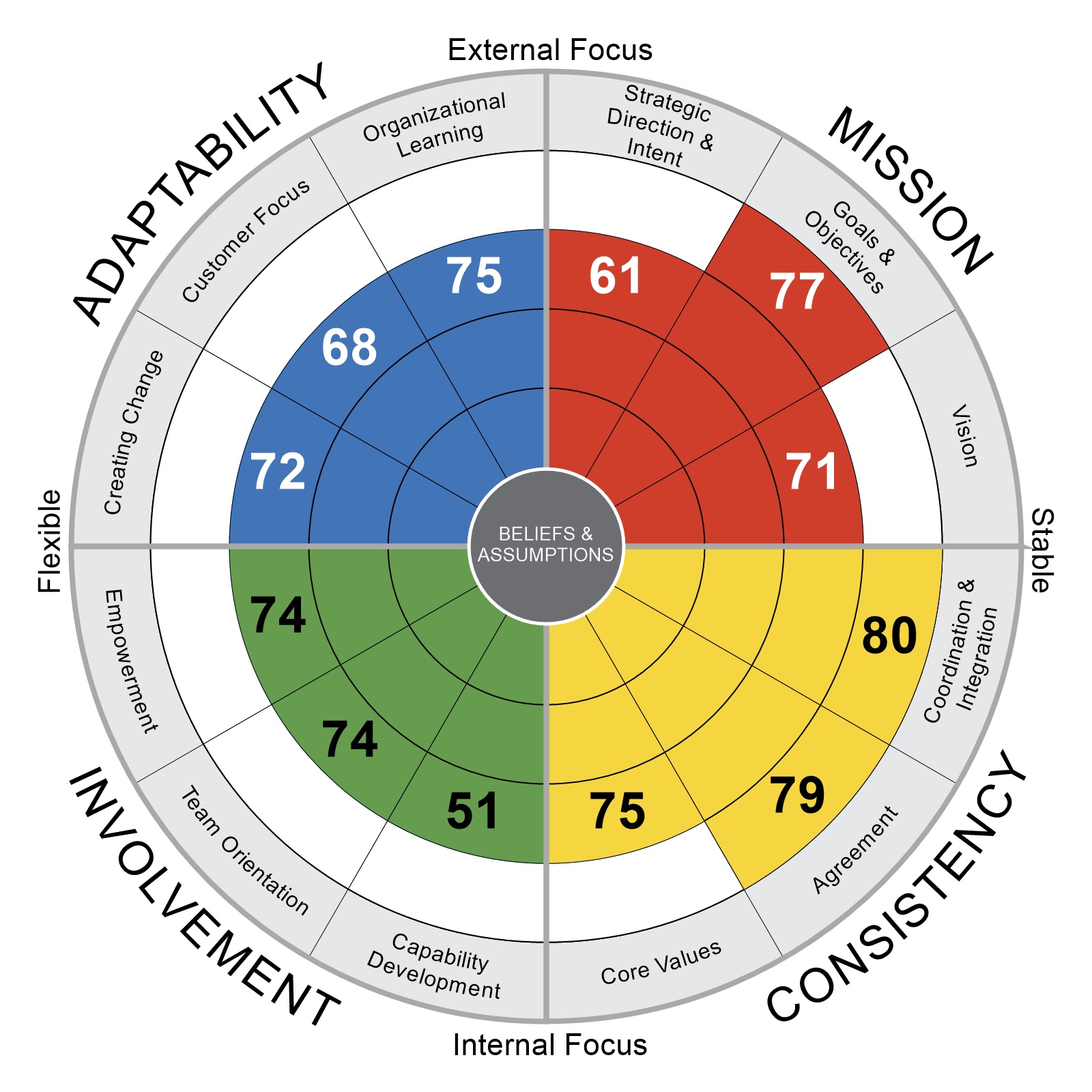

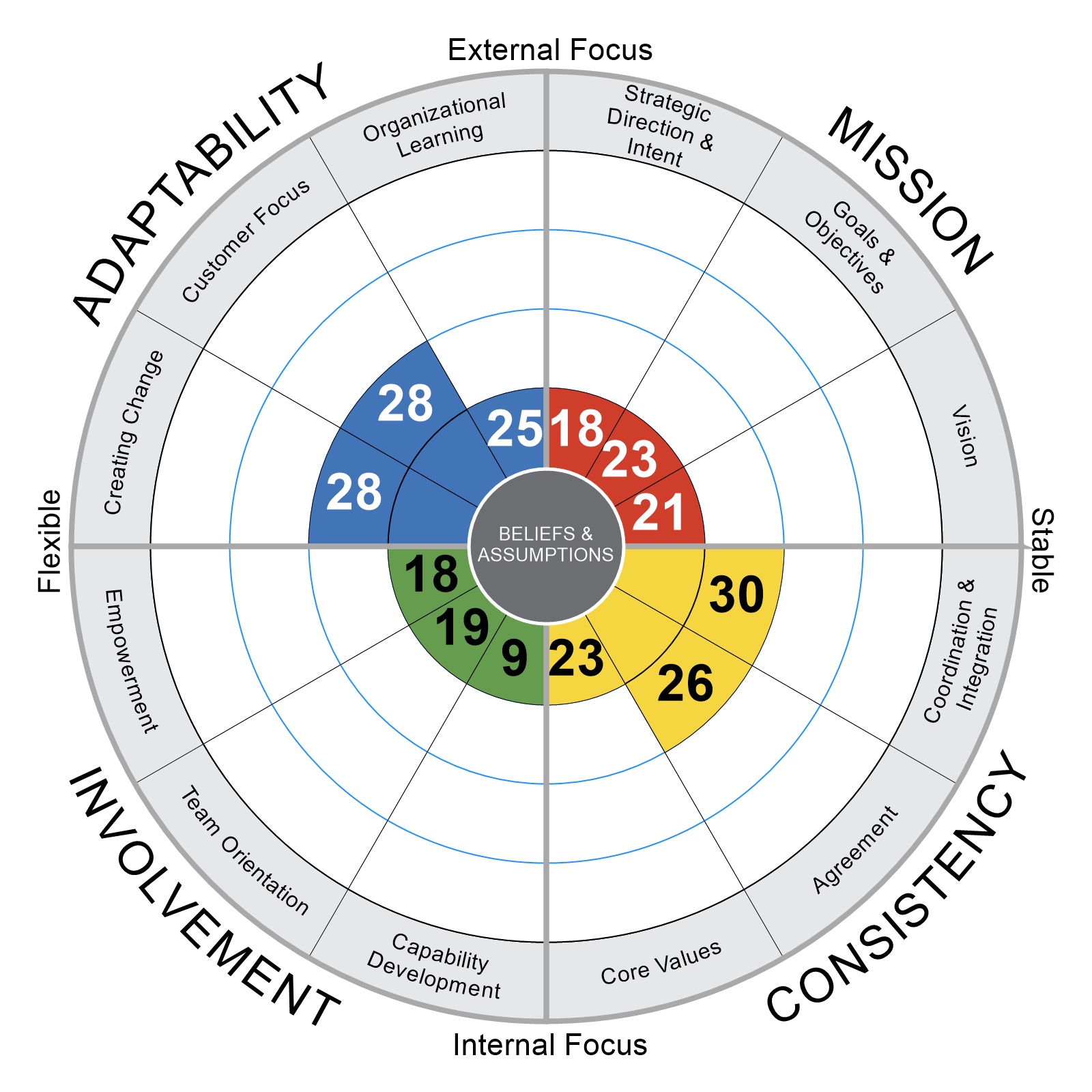

For example, we did a study for a leading PE firm that showed portfolio companies scoring in the top third on the Denison Model Index saw EBITDA growth of 17% and Sales growth of 6%. Contrast that with the bottom third, which saw an EBITDA decline of -1% and a Sales decline of -4%.

TOP THIRD OF PORTFOLIO COMPANIES

Denison Model Assessment Scores

EBITDA Growth of 17% with Sales Growth of 6%

EBITDA Growth of 17% with Sales Growth of 6%

BOTTOM THIRD OF PORTFOLIO COMPANIES

Denison Model Assessment Scores

EBITDA Decline of -1% and Sales Decline of -4%

EBITDA Decline of -1% and Sales Decline of -4%

A thriving, measured, and well-managed culture is a leading indicator of operating performance success, producing a more highly valued company. PE firms that take a systematic approach to culture will tell you that they see the benefits, so we can expect more and more PE firms to adopt this value-creating advantage.

At our Global Forum event this year, we had an insightful fireside chat with Pierre Schuurmans of Birch Hill Equity Partners who spoke at length about how his firm has realized, embraced, and operationalized the measurement of culture in managing their investment portfolio.

After working closely with Denison Consulting, Pierre concluded that financial success follows when CEOs focus on building a great company more than maximizing their personal compensation. This conclusion is at the heart of a combined view of culture, leadership, and organizational effectiveness.

The conclusion…

CEOs prioritizing creating a great business with a strong culture generate the most value.

CEOs are busy. And a new CEO or a CEO who has just sold to Private Equity is even busier. Leveraging culture early can guide the focus and pace of operating performance to maximize results.

If you’re a CEO or Private Equity Investor looking for ways to accelerate operating performance success, let’s chat.